Kicking off with Credit Score Improvement, this topic dives into why improving your credit score is crucial for your financial well-being. From securing lower loan interest rates to increasing your chances of mortgage approvals, a better credit score opens up a world of financial opportunities.

Understanding the key factors that influence your credit score and implementing effective strategies can make a significant impact on your overall financial health.

Importance of Credit Score Improvement

Improving your credit score is crucial for maintaining good financial health. A higher credit score can open doors to better financial opportunities and savings in the long run.

Lower Interest Rates on Loans

Having a better credit score can lead to lower interest rates on loans, saving you money over time. Lenders use credit scores to determine how risky it is to lend you money. The higher your credit score, the lower the risk, resulting in better interest rates for you.

Impact on Mortgage Approvals

Credit scores play a significant role in mortgage approvals. A higher credit score increases your chances of getting approved for a mortgage loan and may also qualify you for better terms. On the other hand, a lower credit score can limit your options and result in higher interest rates or even denial of approval.

Factors Influencing Credit Score

When it comes to determining an individual’s credit score, there are several key factors that play a crucial role in shaping this financial metric. These factors can have a significant impact on a person’s ability to access credit and secure favorable terms for loans and other financial products.

Payment History

Payment history is one of the most important factors that influence a credit score. It accounts for approximately 35% of the total score and reflects how consistently an individual has paid their bills on time. Late payments, defaults, or accounts in collections can have a negative impact on the credit score, while a history of on-time payments can help boost it.

Credit Utilization

Credit utilization refers to the amount of credit a person is using compared to the total amount of credit available to them. This ratio is a key component of credit score calculations and can significantly impact the score. Keeping credit utilization low, typically below 30%, shows lenders that an individual is using credit responsibly and can help improve their credit score over time.

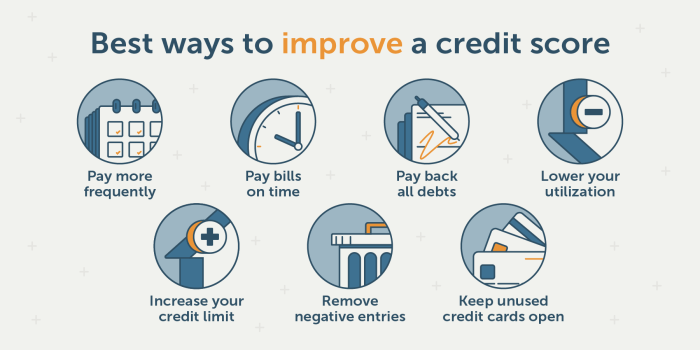

Strategies for Credit Score Improvement

Improving your credit score is essential for better financial opportunities. By following these effective strategies, you can boost your credit score and increase your chances of qualifying for loans and lower interest rates.

Pay Bills on Time

One of the most crucial factors affecting your credit score is payment history. Make sure to pay all your bills on time to avoid negative marks on your credit report. Set up automatic payments or reminders to stay on track.

Reduce Credit Card Balances

High credit card balances can negatively impact your credit score. Aim to keep your credit card balances below 30% of your available credit limit. Paying down balances can help improve your credit utilization ratio and boost your credit score.

Monitoring and Maintaining Credit Scores

Regularly monitoring your credit score is crucial in maintaining good financial health. By keeping an eye on your credit score, you can catch any inaccuracies or fraudulent activities early on, preventing major damage to your creditworthiness.

Tools and Resources for Tracking Changes

- Utilize free credit monitoring services offered by credit bureaus such as Equifax, Experian, and TransUnion.

- Consider signing up for credit monitoring services from third-party companies like Credit Karma or Credit Sesame.

- Set up alerts on your credit accounts to receive notifications of any changes or suspicious activities.

Best Practices for Maintaining a Good Credit Score, Credit Score Improvement

- Pay your bills on time every month to avoid late payments negatively impacting your credit score.

- Keep your credit utilization ratio low by not maxing out your credit cards and maintaining a low balance relative to your credit limit.

- Avoid opening multiple new credit accounts within a short period, as this can signal financial instability to lenders.

- Regularly review your credit reports for errors and dispute any inaccuracies to maintain an accurate credit history.

- Use credit responsibly by only applying for credit when needed and managing your debts effectively.