Budgeting for Families sets the stage for financial success, offering insights into effective money management and smart saving strategies that can benefit the whole household. From setting up a budget to involving children in financial discussions, this topic covers essential aspects of family finance.

Learn how to navigate the world of family budgeting with practical tips and engaging activities that promote financial literacy and responsible spending habits for a secure tomorrow.

Importance of Budgeting for Families

Budgeting is crucial for families as it helps them track their income and expenses, prioritize spending, and save for the future. Effective budgeting can have a significant impact on family finances by reducing debt, increasing savings, and improving overall financial stability. It allows families to set financial goals and work towards achieving them, whether it’s buying a house, saving for education, or planning for retirement.

Impact of Effective Budgeting

- Budgeting helps families avoid overspending and accumulating debt, leading to financial stress and instability.

- By creating a budget, families can identify areas where they can cut expenses and save money, ultimately increasing their overall savings.

- Effective budgeting allows families to plan for unexpected expenses and emergencies, providing a financial safety net during challenging times.

- With a budget in place, families can track their progress towards their financial goals and make adjustments as needed to stay on track.

Tips for Creating a Family Budget: Budgeting For Families

Creating a family budget can be a crucial step in managing finances effectively and achieving financial goals. By following some key tips and strategies, families can set up a budget that works for them.

Step-by-Step Guide for Setting Up a Family Budget

- Calculate Total Income: Determine the total monthly income for the household, including salaries, bonuses, and any other sources of income.

- List Fixed Expenses: Identify fixed expenses such as rent/mortgage, utilities, insurance, and loan payments.

- Track Variable Expenses: Keep track of variable expenses like groceries, entertainment, dining out, and transportation costs.

- Set Financial Goals: Establish short-term and long-term financial goals to guide budgeting decisions.

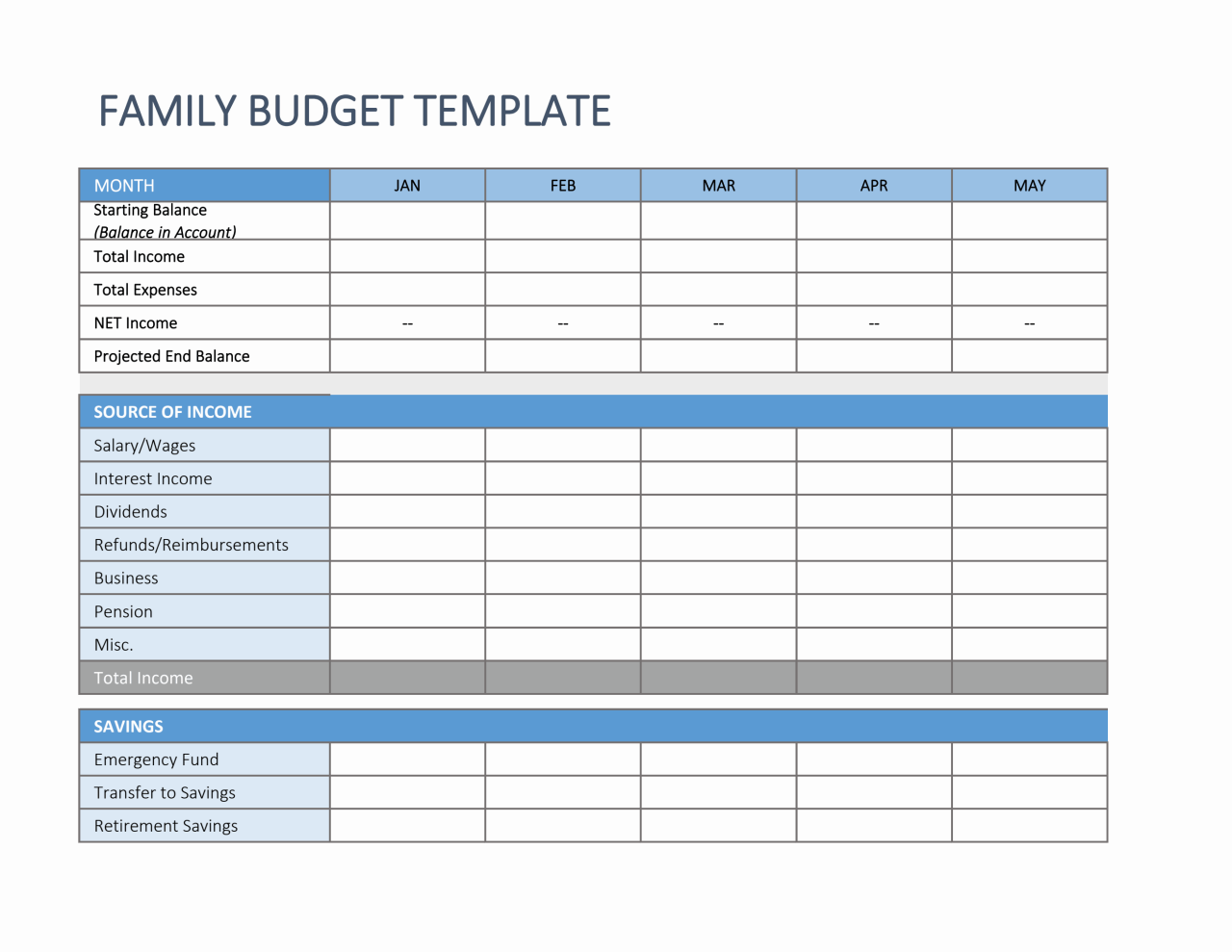

- Create a Budget: Use a budgeting tool or spreadsheet to allocate income to different expense categories based on priorities and goals.

Key Categories to Include in a Family Budget

- Housing: Rent or mortgage payments, property taxes, insurance.

- Utilities: Electricity, water, gas, internet, phone.

- Transportation: Car payments, fuel, maintenance, public transportation.

- Groceries: Food and household essentials.

- Insurance: Health, life, auto, home insurance premiums.

- Debt Payments: Credit card bills, student loans, personal loans.

Strategies for Tracking Expenses and Managing Income

- Keep Receipts: Save receipts and track expenses to stay within budget limits.

- Use Budgeting Apps: Utilize budgeting apps to monitor spending and income in real-time.

- Review Regularly: Review the budget regularly to make adjustments and ensure financial goals are being met.

- Emergency Fund: Allocate a portion of income to an emergency fund for unexpected expenses.

- Seek Professional Help: Consider consulting a financial advisor for guidance on managing finances effectively.

Involving Children in Family Budgeting

When it comes to family budgeting, getting children involved from a young age can have numerous benefits. Not only does it help them understand the value of money and the importance of financial planning, but it also teaches them essential life skills that will benefit them in the long run.

Benefits of Involving Children in Budgeting Discussions

- Teaches responsibility and accountability

- Helps children understand the concept of saving and setting financial goals

- Promotes open communication within the family

- Encourages critical thinking and decision-making skills

Age-Appropriate Ways to Teach Children About Budgeting

- Use clear and simple language to explain financial concepts

- Start with small tasks like creating a savings jar for their allowance

- Set a good example by involving them in everyday budgeting decisions

- Encourage them to prioritize their spending and differentiate between needs and wants

Developing Financial Literacy Skills Through Budgeting

- Teaching children about budgeting early on can help them make informed financial decisions in the future

- Understanding the value of money and budgeting can instill good financial habits that last a lifetime

- Children who are involved in budgeting discussions are more likely to be financially responsible adults

- Learning to budget can empower children to take control of their financial future and work towards their goals

Saving Strategies for Families

Saving money as a family is crucial for financial stability and achieving long-term goals. By implementing effective saving strategies, families can build a strong financial foundation and be better prepared for unexpected expenses.

Importance of Emergency Funds

Emergency funds play a vital role in family budgeting as they provide a safety net for unforeseen circumstances such as medical emergencies, car repairs, or job loss. It is recommended to have at least three to six months’ worth of living expenses saved in an emergency fund to cover unexpected costs without derailing the family budget.

Creative Ways to Cut Expenses

- Meal Planning: Planning meals in advance can help families save money on groceries by avoiding unnecessary purchases and reducing food waste.

- Energy Efficiency: Making small changes like using energy-saving appliances, turning off lights when not in use, and insulating the home can lead to significant savings on utility bills.

- DIY Projects: Instead of hiring professionals for home repairs or renovations, consider taking on DIY projects as a family to save on labor costs.

- Second-Hand Shopping: Buying gently used items or clothing from thrift stores, garage sales, or online marketplaces can help families save money on essentials.

Budget-Friendly Family Activities

Spending quality time together as a family doesn’t have to break the bank. There are plenty of budget-friendly activities that families can enjoy without straining their finances. Finding the right balance between leisure activities and budget constraints is key to creating lasting memories without overspending.

Outdoor Adventures

- Take a hike or nature walk in a local park

- Have a picnic in the backyard or at a nearby scenic spot

- Go on a bike ride around the neighborhood

At-Home Fun

- Have a family movie night with homemade popcorn

- Organize a game night with board games or card games

- Get creative with DIY arts and crafts projects

Community Events, Budgeting for Families

- Attend free concerts or movie screenings in the park

- Visit local museums on discounted or free admission days

- Participate in community festivals or fairs