Budgeting for Families sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

In today’s fast-paced world, managing finances as a family can be a challenge. However, with the right budgeting techniques and strategies, families can secure their financial future and create a stable foundation for their loved ones. This guide dives into the importance of budgeting for families, setting up a family budget, saving strategies, teaching children about budgeting, and budget-friendly family activities. Get ready to take control of your finances and pave the way for a brighter future for your family!

Importance of Budgeting for Families

Budgeting is like the secret sauce for families to stay on top of their finances and make sure they’re not overspending on things they don’t really need. It’s all about planning ahead and making sure you have enough money for the things that matter most.

Benefits of Creating a Family Budget

Creating a family budget can help you track your expenses, identify areas where you can cut back, and ultimately save more money for important things like vacations, emergencies, or even college funds for the kiddos. It also helps reduce stress and conflicts over money within the family.

How Budgeting Can Help Families Achieve Financial Goals

Budgeting allows families to set specific financial goals, whether it’s paying off debt, saving for a new car, or buying a house. By keeping track of your income and expenses, you can allocate funds towards these goals and make sure you’re on the right track to achieve them. Plus, it helps you stay accountable and motivated to reach those milestones.

Setting Up a Family Budget

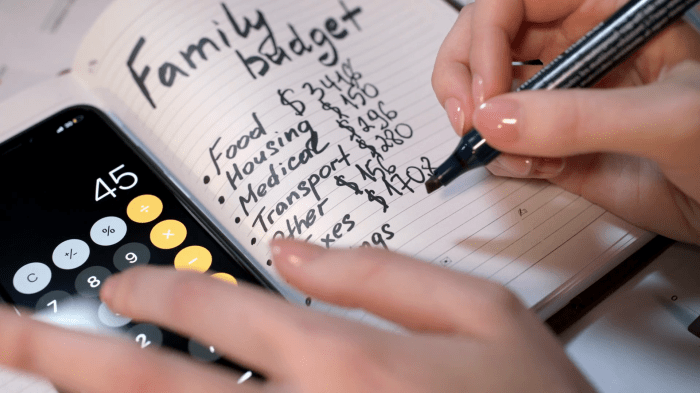

Setting up a family budget is crucial for financial stability and achieving financial goals. It involves careful planning and organization to ensure that income is effectively allocated to cover expenses and savings. Here are the steps to help you set up a family budget:

Determining Income and Expenses

To begin, calculate your total monthly income, including salaries, bonuses, and any other sources of revenue. Next, list down all your monthly expenses, such as rent/mortgage, utilities, groceries, transportation, and other bills. Be sure to include both fixed expenses (e.g., rent) and variable expenses (e.g., groceries).

- Tip 1: Consider all sources of income, including side gigs or freelance work.

- Tip 2: Keep track of all expenses, even small ones like coffee or snacks.

- Tip 3: Use tools like budgeting apps or spreadsheets to help you organize your finances.

Importance of Tracking Spending

Tracking your spending is essential to stay within your budget and identify areas where you can cut back or save more. By monitoring your expenses regularly, you can make adjustments as needed to ensure that you are on track to meet your financial goals.

Remember: A budget is not set in stone; it should be flexible and adaptable to changes in your financial situation.

Saving Strategies for Families

When it comes to saving money as a family, there are several strategies you can incorporate into your budget to help you reach your financial goals. From setting up an emergency fund to finding ways to save on common family expenses, being proactive about saving can make a significant difference in the long run.

Importance of Emergency Funds

Emergency funds are crucial for families to have financial security and peace of mind during unexpected events or emergencies.

- Set aside at least 3-6 months’ worth of living expenses in an easily accessible account.

- Use automatic transfers from your paycheck to build up your emergency fund gradually.

- Only use the fund for true emergencies, such as medical expenses or unexpected home repairs.

Saving Money on Common Family Expenses

Reducing expenses on everyday items can help families save more money for the future.

- Shop in bulk or buy generic brands to save on groceries.

- Use coupons, cashback apps, and loyalty programs when shopping for essentials.

- Limit eating out and cook meals at home to save on dining expenses.

- Bundle services like cable, internet, and phone to get discounted rates.

- Consider DIY projects for home repairs and improvements instead of hiring professionals.

Teaching Children About Budgeting

Teaching children about budgeting is crucial to help them develop financial literacy from a young age. By introducing budgeting concepts early on, children can learn the value of money, how to prioritize spending, and the importance of saving for the future.

Age-Appropriate Ways to Introduce Budgeting Concepts

- Start with simple concepts like distinguishing between needs and wants.

- Use a piggy bank to teach the basics of saving money.

- Involve children in grocery shopping and explain the importance of comparing prices and making smart choices.

Involving Children in Budgeting for Financial Literacy

- Allocate a portion of their allowance for savings and encourage them to set financial goals.

- Have regular discussions about family budgeting decisions and involve children in setting priorities.

- Teach them the concept of budgeting for special occasions like birthdays or holidays.

Budget-Friendly Family Activities

Spending quality time together as a family doesn’t have to break the bank! There are plenty of budget-friendly activities that can be included in your family budget, allowing you to have fun without overspending.

Outdoor Adventures, Budgeting for Families

- Take a hike at a local park or nature reserve.

- Have a picnic in your backyard or at a nearby beach.

- Go for a bike ride around your neighborhood or on a local trail.

Creative Fun at Home

- Have a family movie night with homemade popcorn.

- Organize a DIY craft session using supplies you already have at home.

- Plan a game night with board games or card games.

Community Events and Activities

- Check out free or low-cost events in your community such as concerts, festivals, or farmer’s markets.

- Attend library storytime or workshops for kids.

- Volunteer together as a family at a local charity or organization.

Remember, the most important thing is spending time together as a family, no matter the activity or cost involved.