Customer Acquisition Cost sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

In the world of business, understanding the cost of acquiring new customers is crucial for sustainable growth and success. Let’s dive into the intricacies of Customer Acquisition Cost and how it influences business strategies across various industries.

What is Customer Acquisition Cost (CAC)?

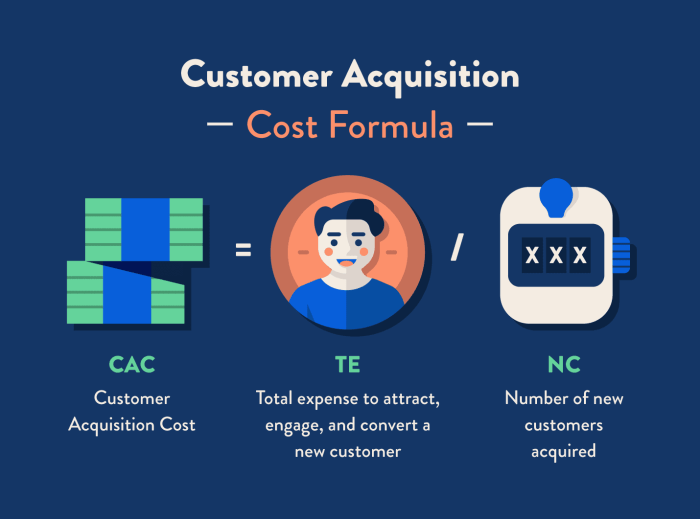

Customer Acquisition Cost (CAC) is a crucial metric in business that refers to the total cost a company incurs to acquire a new customer. It is an essential factor in determining the effectiveness of marketing and sales strategies, as well as the overall profitability of a business.

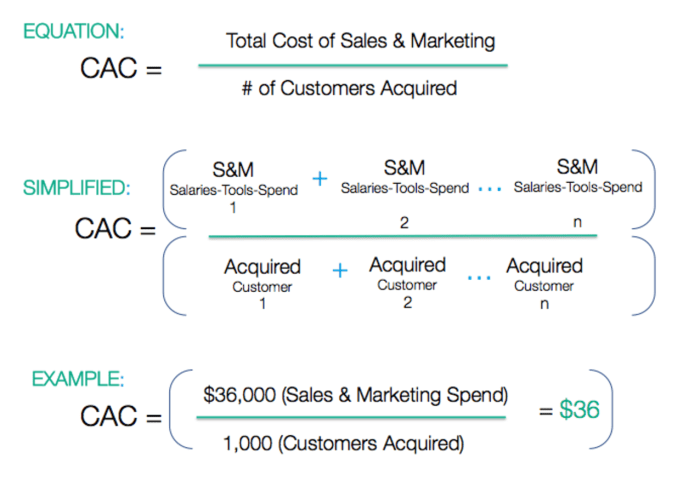

CAC is calculated by dividing the total costs associated with acquiring customers (such as marketing expenses, sales team salaries, and other related costs) by the number of new customers acquired during a specific period. The formula for calculating CAC is as follows:

CAC = Total Costs / Number of New Customers Acquired

Examples of CAC in Different Industries

- In the E-commerce Industry: E-commerce companies often invest heavily in digital marketing, social media advertising, and customer acquisition strategies. The CAC for an e-commerce business can include costs related to website development, online advertising, and shipping fees.

- In the Software as a Service (SaaS) Industry: SaaS companies typically have a subscription-based business model and focus on acquiring and retaining customers over the long term. The CAC for a SaaS company may include costs related to software development, customer support, and sales team salaries.

- In the Retail Industry: Retail businesses may incur costs related to traditional advertising, in-store promotions, and loyalty programs to acquire new customers. The CAC for a retail company can vary depending on the type of products sold and the target market.

Factors influencing Customer Acquisition Cost

Customer Acquisition Cost (CAC) can be influenced by a variety of factors that businesses need to consider in order to optimize their marketing strategies and maximize ROI.

Marketing Channels Impact on CAC

Different marketing channels can have varying impacts on CAC due to their unique characteristics and audience reach. Here’s a comparison of how different channels can affect CAC:

- Organic Search: Organic search traffic tends to have a lower CAC as it targets users actively searching for specific products or services, resulting in higher conversion rates.

- Social Media Advertising: Social media ads can have a higher CAC compared to organic search due to the need for continuous optimization and targeting to reach the right audience.

- Referral Programs: Referral programs often have a lower CAC as satisfied customers refer others to the business, leading to higher-quality leads and conversions.

- Content Marketing: Content marketing can have a moderate CAC, as it focuses on providing valuable information to attract and engage customers, leading to long-term relationships and loyalty.

- Email Marketing: Email marketing usually has a lower CAC as businesses can target existing customers and leads, resulting in higher conversion rates and lower acquisition costs.

Optimizing CAC Strategies

To optimize CAC and improve overall marketing performance, businesses can implement the following strategies:

- Targeting the Right Audience: By focusing on the target audience most likely to convert, businesses can reduce CAC by avoiding unnecessary spending on uninterested leads.

- Conversion Rate Optimization: Improving website and landing page design, as well as optimizing ad copy and calls-to-action, can increase conversion rates and lower CAC.

- Retention Strategies: Investing in customer retention programs can reduce CAC by increasing customer lifetime value and encouraging repeat purchases.

- Data Analysis: Regularly analyzing marketing data and performance metrics can help identify areas for improvement and optimize marketing campaigns for lower CAC.

- Testing and Iteration: Continuously testing different marketing strategies, channels, and messaging can help businesses identify the most cost-effective approaches to customer acquisition.

Importance of monitoring CAC

Monitoring Customer Acquisition Cost (CAC) is crucial for businesses to ensure they are efficiently acquiring customers and maximizing their return on investment. By closely tracking CAC, companies can make informed decisions about their marketing strategies and allocate resources effectively.

Influencing Decision-Making

- Tracking CAC allows businesses to identify which marketing channels are most cost-effective in acquiring customers. For example, if a company realizes that social media ads have a lower CAC compared to traditional print advertising, they can reallocate their budget accordingly to maximize ROI.

- Monitoring CAC also helps businesses optimize their sales and marketing processes. By understanding the cost associated with acquiring a customer, companies can streamline their sales funnel and improve conversion rates, ultimately reducing CAC and increasing profitability.

- Additionally, tracking CAC enables businesses to set realistic growth targets and measure the effectiveness of their customer acquisition strategies over time. This data-driven approach allows companies to make adjustments as needed to ensure long-term success.

Relationship with Customer Lifetime Value, Customer Acquisition Cost

- The relationship between CAC and Customer Lifetime Value (CLV) is essential for businesses to determine their overall profitability. By comparing the cost of acquiring a customer (CAC) with the revenue generated from that customer over their lifetime (CLV), companies can assess the long-term value of their customer relationships.

- A lower CAC relative to CLV indicates a healthy business model with strong customer retention and high profitability. On the other hand, a high CAC compared to CLV may signal inefficiencies in customer acquisition or retention strategies that need to be addressed to improve overall financial performance.

- By monitoring both CAC and CLV, businesses can make data-driven decisions to optimize their customer acquisition processes, enhance customer loyalty, and maximize profitability in the long run.

CAC benchmarks and industry standards

When it comes to Customer Acquisition Cost (CAC), understanding benchmarks and industry standards is crucial for businesses to assess their performance and make informed decisions.

Typical CAC benchmarks across different sectors

- In the software industry, the average CAC can range from $7 to $200.

- For e-commerce businesses, CAC benchmarks vary widely but can fall between $10 to $100.

- In the healthcare sector, CAC tends to be higher, averaging around $200 to $400.

Comparison of CAC metrics for startups versus established companies

- Startups often have higher CAC as they are still building brand awareness and customer base. Their CAC can range from $100 to $500.

- Established companies, with a loyal customer base and more efficient marketing strategies, typically have lower CAC, averaging around $50 to $100.

Insights on how companies analyze CAC data

- Companies analyze CAC data to determine the effectiveness of their marketing campaigns and channels.

- They track CAC over time to identify trends and make adjustments to improve efficiency.

- By comparing CAC with Customer Lifetime Value (CLV), companies can assess the long-term profitability of acquiring customers.